Tennessee Reviews Establishing a Handle Tax amidst Skyrocketing Sportsbook Earnings

Tennessee has set itself apart from other states when it comes to legalizing sports betting by only allowing online wagering. Now, the state may once again challenge traditional customs.

Bills have been presented in both chambers of the Tennessee General Assembly, proposing a change to the 20% tax on revenue. Instead, the state would collect a percentage of each wager placed, regardless of whether the sportsbook or the bettor wins.

Senate Bill 475, sponsored by state Senator John Stevens (R-Huntingdon), suggests a 2% tax, while the house's bill proposes 1.85%. Both versions would also allow sportsbooks to deduct the 0.25% federal excise tax on their handle but not any promotional credits.

Tennessee would become the first state to levy a sports betting tax by handle if the legislature approves either bill.

House Bill 1362, introduced by state Representative Andrew Farmer (R-Sevierville), also proposes amendments to the annual license renewal fee structure. Instead of all operators paying a $750,000 annual fee to operate in Tennessee, only those sportsbooks with a handle of $500 million or more would pay this amount.

Those accepting more than $100 million in wagers but under $500 million would pay $500,000, and operators with handles of less than $100 million would pay $250,000. All new licensees would still need to pay the $750,000 fee when their applications are first approved.

Farmer reassured colleagues during a House committee meeting that the proposed changes would not impose a significant burden, while emphasizing the state's goal of being "as business friendly as possible."

Both bills have progressed through their respective chambers, with Farmer's bill scheduled for a hearing on Wednesday in the House Finance, Ways, and Means Subcommittee and Stevens' legislation appearing before the Senate Finance, Ways, and Means Committee the following week.

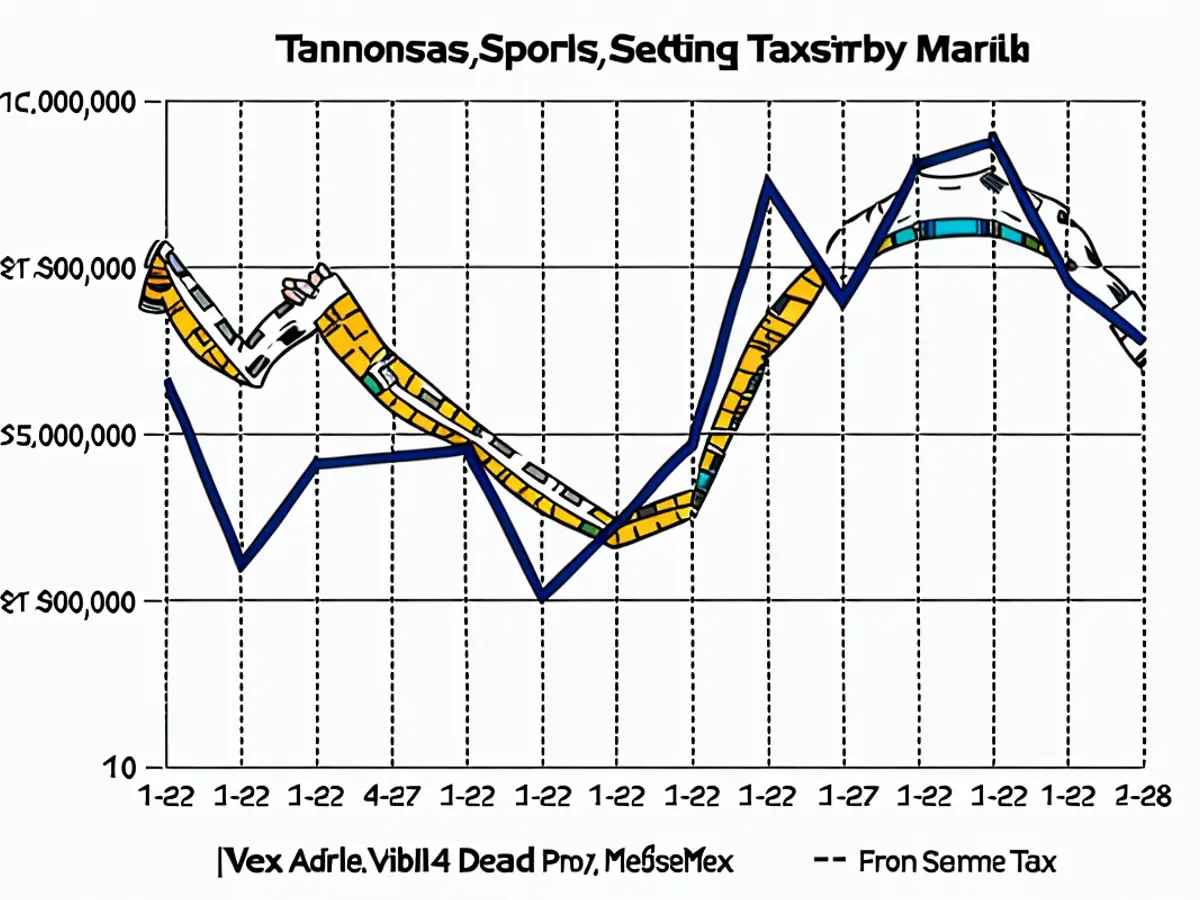

According to reports from the Tennessee Sports Wagering Advisory Committee (SWAC), if either chamber's handle tax had been in place for 2022, the state would have generated more tax revenue for the year. This estimation is based on a description of how the tax would work, with sportsbooks subtracting the 0.25% excise tax from the total handle and then taxing the remaining amount.

Tennessee sports bettors placed $3.85 billion in bets last year, with sportsbooks paying $9.6 million to the federal government.

SWAC reported that Tennessee collected approximately $68.1 million in tax revenue for the year. The Senate's tax plan would have generated roughly $76.8 million, an increase of around $8.8 million. The House's lower tax would have also resulted in a small increase, as the state would have received $71.1 million.

The House bill reduces the state's revenue from license fees since few of the 13 licensed operators would have had handles exceeding $500 million last year. While SWAC does not break down handle and revenue by operator, it is likely that FanDuel and DraftKings, which have the highest market shares in most states, would fall into the higher tax bracket.

One important point to note is that the tax change coincides with sportsbooks achieving their highest revenue totals ever in Tennessee. The six most profitable months have been the past six, with December's total revenue reaching $47 million, a new record.

Based on calculations, the Senate's handle tax would have generated less revenue for the state in four of the last six months, and the House's handle tax in three. While lawmakers and sportsbooks hope that interest and handle figures will continue to rise, these numbers may potentially decline in the future.

Only two of Tennessee's neighboring states - Arkansas and Virginia - currently offer online sports betting. Mississippi and North Carolina allow it at physical casinos. Georgia, Kentucky, and Missouri are discussing legalizing online wagering. Some of these states still have a chance to pass bills this year.

As these neighboring states open up to mobile sports betting, it is believed that they will impact the traffic within Tennessee. During a recent Kentucky Senate Licensing and Occupations Committee hearing, lawmakers from Southern Kentucky remarked on friends from their districts who travel across state lines every weekend to place bets.

The discussion about a handle tax seems timely, particularly given the recent peaks in revenue and uncertain handles in the future.

Read also:

- Leverkusen claims victory in the cup, securing a double triumph.

- Alonso achieves a double victory after consuming a German brew.

- Does the SVolt factory in Saarland face stability issues?

- Furor surrounding Sylt scandal footage