MGM Shares Indicate Potential Short-Term Price Surge

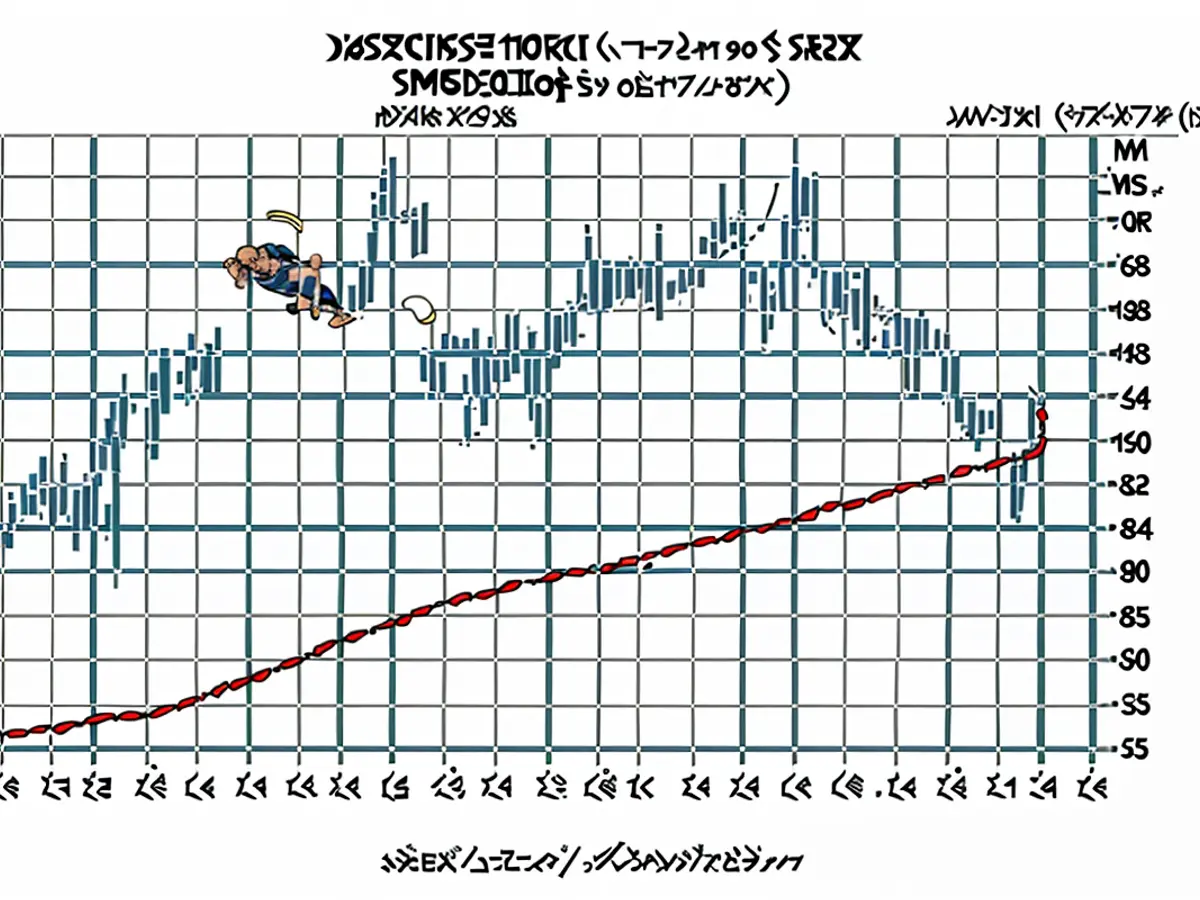

Stocks of MGM Resorts International (NYSE: MGM) have dipped by 5% over the past month but have surged by the same amount over the past week. Technical analysis suggests that a further uptrend might be on the horizon for this casino operator.

The stock, like other gaming companies, is facing challenges in Q2. However, its proximity to its 160-day moving average might position it advantageously. It currently resides within one standard deviation of that crucial technical level.

As reported by Schaeffer’s Senior Quantitative Analyst Rocky White, four similar signals occurred in the past three years, and the stock closed higher each time, with an average 10.3% one-month gain, according to Schaeffer’s Investment Research.

In layman's terms, standard deviation measures a dataset's spread compared to its average. It is calculated by determining the deviation of each data point from the average.

Other Bullish Signals for MGM Stock

Should MGM show a similar trend from its 160-day average, it could revisit the high it touched following its first-quarter earnings report in 2023. In other words, that moving average, much like other technical indicators, could function as a support zone for the stock.

Options traders also seem optimistic about MGM stock, either anticipating minimal declines in the short term or a potential surge.

A reversal of pessimism among options traders could generate additional momentum. MGM's Schaeffer's put/call open interest ratio (SOIR) of 1.30 falls within the 96th percentile of figures from the previous year, suggesting a predominantly bearish sentiment among short-term options traders.

Options premiums, or the rates traders pay for these contracts, for MGM are currently not elevated compared to historical standards, signaling that market participants don't anticipate significant volatility in the stock over the short term. A lack of volatility might facilitate gains.

MGM's Financial Health

By the end of YTD, MGM stock is up by 22.91%, overshadowing the 11.59% gained by the S&P 500. This shows strong fundamentals, which MGM can leverage in the second half of 2023.

Potential growth drivers for MGM include persistent enthusiasm on the Las Vegas Strip, where it is the primary operator, and further impetus for the Macau recovery. MGM's results in Sin City were robust in Q1, and this scenario could be bolstered by a packed event calendar in the latter half of the year.

In terms of direct impact on the share price, MGM could impress investors by maintaining its large-scale share buybacks, a practice it has pursued in recent years, and by disclosing that its BetMGM is trimming losses and is on track to achieve profitability before the end of 2023.

Read also:

- Leverkusen claims victory in the cup, securing a double triumph.

- Alonso achieves a double victory after consuming a German brew.

- Does the SVolt factory in Saarland face stability issues?

- Furor surrounding Sylt scandal footage