Which occupations are eligible for tax exemption on tip earnings?

In a significant move for the millions of tipped workers across the United States, the Treasury and IRS have proposed regulations that include a temporary federal income tax deduction for qualified tips. Known as the "No Tax on Tips" Deduction, this provision is expected to provide relief for eligible workers starting from the tax year 2025.

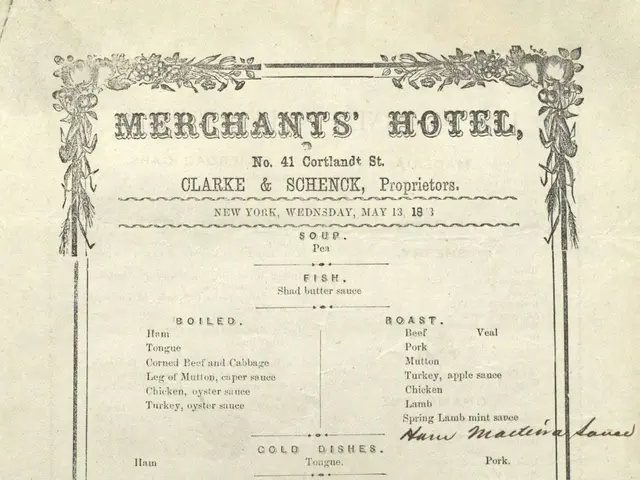

The official list of occupations eligible for this deduction will be published in the Federal Register. As per the preliminary list released by the Treasury, professions such as taxi drivers, hairstylists, and food servers are among those that may qualify. However, public comments will be requested on this official list, as well as other pieces of the proposed regulations, to ensure a comprehensive and fair implementation.

Qualified tips are voluntary cash or charged tips received from customers or through tip sharing. These tips are reportable and taxable at the state and local level, but under the new deduction, a portion of them will become tax-exempt at the federal level. The deduction is retroactive to the beginning of the tax year 2025 and applies for the tax years 2025 through 2028.

The deduction is limited to $25,000 of reported qualified tips per year. It's important to note that this is a federal income tax deduction, not an exclusion. Payroll taxes (Social Security and Medicare) still apply to tip income.

A new Box 14b will be used to report the Treasury occupation code for an employee's tipped occupation on their Form W-2. The IRS has confirmed that there will be no changes to Form W-2 for the tax year 2025. However, the new draft Form W-2 for 2026 includes three new Box 12 codes, including code TP for Total amount of qualified tips (for figuring the new "no tax on tips" deduction).

The deduction phases out with modified adjusted gross income over $150,000 ($300,000 for joint filers). More information about the "no tax on tips" provision is expected to come, and subscribing to Forbes' free tax newsletter will provide updates on this and other tax-related news.

It's essential to remember that regulations are official interpretations of the law and allow for public comment before publication. The official occupation list will be published in the Federal Register, and taxpayers who receive qualified tips in occupations listed as customarily and regularly receiving tips on or before December 31, 2024, will be able to benefit from this new deduction.

In conclusion, the "No Tax on Tips" Deduction is a significant step forward for tipped workers, offering them a much-needed tax relief. Stay informed, and ensure you understand the implications of this deduction for your tax situation.

Read also:

- Peptide YY (PYY): Exploring its Role in Appetite Suppression, Intestinal Health, and Cognitive Links

- Toddler Health: Rotavirus Signs, Origins, and Potential Complications

- Digestive issues and heart discomfort: Root causes and associated health conditions

- House Infernos: Deadly Hazards Surpassing the Flames