Troubles ahead for employees, positive developments for individuals obtaining mortgages

Mortgage Rates Reach New 2025 Lows Amidst Slowing Job Growth and Economic Uncertainty

In a surprising turn of events, mortgage rates have plummeted to their lowest levels since April, reaching new 2025 lows. This development comes at a time when the U.S. economy is grappling with slowing job growth and rising inflation concerns.

As of Wednesday, the average rate on a 30-year mortgage stood at 6.55 percent, according to a national survey of lenders. This decrease was prompted by the weak jobs report released on Friday, which showed that the U.S. economy created few jobs in August, with nonfarm payrolls increasing by a mere 22,000. The jobless rate also moved up to 4.3 percent.

The 10-year Treasury yield, a key benchmark for mortgage pricing, dropped on the weak jobs report, reaching about 4.09 percent as of Friday afternoon. Bill Banfield, chief business officer at Rocket Mortgage, stated that mortgage rates have dropped to these new 2025 lows.

However, the impact of the Fed's decision to cut rates might not be felt in the short-term on mortgage rates. Economists are divided about whether the Fed will cut rates at its Sept. 16-17 meeting. Investors, however, are already pricing in a Sept. 17 Fed rate cut to lower rates.

Job growth has slowed and job openings have declined, creating a drag on economic activity. If the data show rising inflation in August, the Fed's decision to cut the short-term federal funds rate will be complicated.

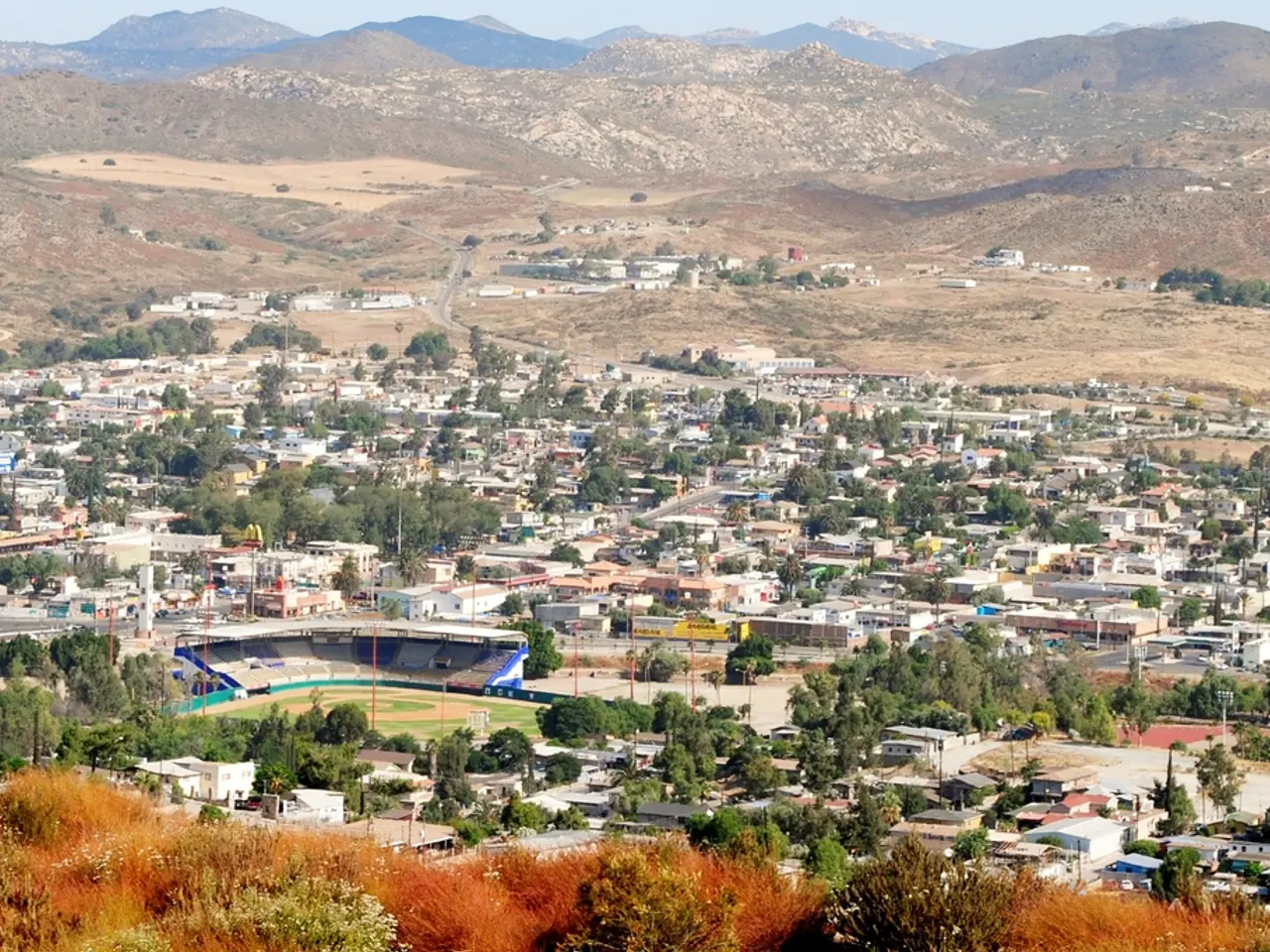

In the housing market, home prices are at record highs. Yet, sellers in most markets are starting to reset expectations on pricing and are prepared to negotiate in a way they have not over the past few years. This could present an opportunity for potential homebuyers, as Banfield suggests that now could be the most opportune time to buy a home.

Homeowners who purchased when rates were above 7.5 percent now have an opportunity to refinance. However, participants in the housing market should not try to time rates, according to Sturtevant. Instead, Banfield encourages homeowners who are waiting for the Fed to cut rates to refinance now.

Looking ahead, mortgage rates are expected to remain relatively stable or fluctuate mildly around current levels in 2025, with no extreme shocks anticipated. However, if the economy falls into a recession, central banks may lower interest rates to ease financial conditions, which could lead to reduced mortgage rates over time.

In conclusion, the recent drop in mortgage rates presents an opportunity for both homebuyers and homeowners looking to refinance. While the future of the economy and mortgage rates remains uncertain, the current climate offers a potential window for those ready to make a move in the housing market.

Read also:

- Peptide YY (PYY): Exploring its Role in Appetite Suppression, Intestinal Health, and Cognitive Links

- Toddler Health: Rotavirus Signs, Origins, and Potential Complications

- Digestive issues and heart discomfort: Root causes and associated health conditions

- House Infernos: Deadly Hazards Surpassing the Flames