Strength of the U.S. Dollar Leads to a Potential Crisis, Claims Morgan Stanley, with S&P 500 Target at 3,000 Points

The US Federal Reserve's push for historically rapid interest rate hikes to combat high inflation has sent shockwaves through the financial market. With two more rate hikes on the horizon in November and December, raising the benchmark rate to at least 4.25 to 4.50 percent, the S&P 500 index is facing a test of resilience.

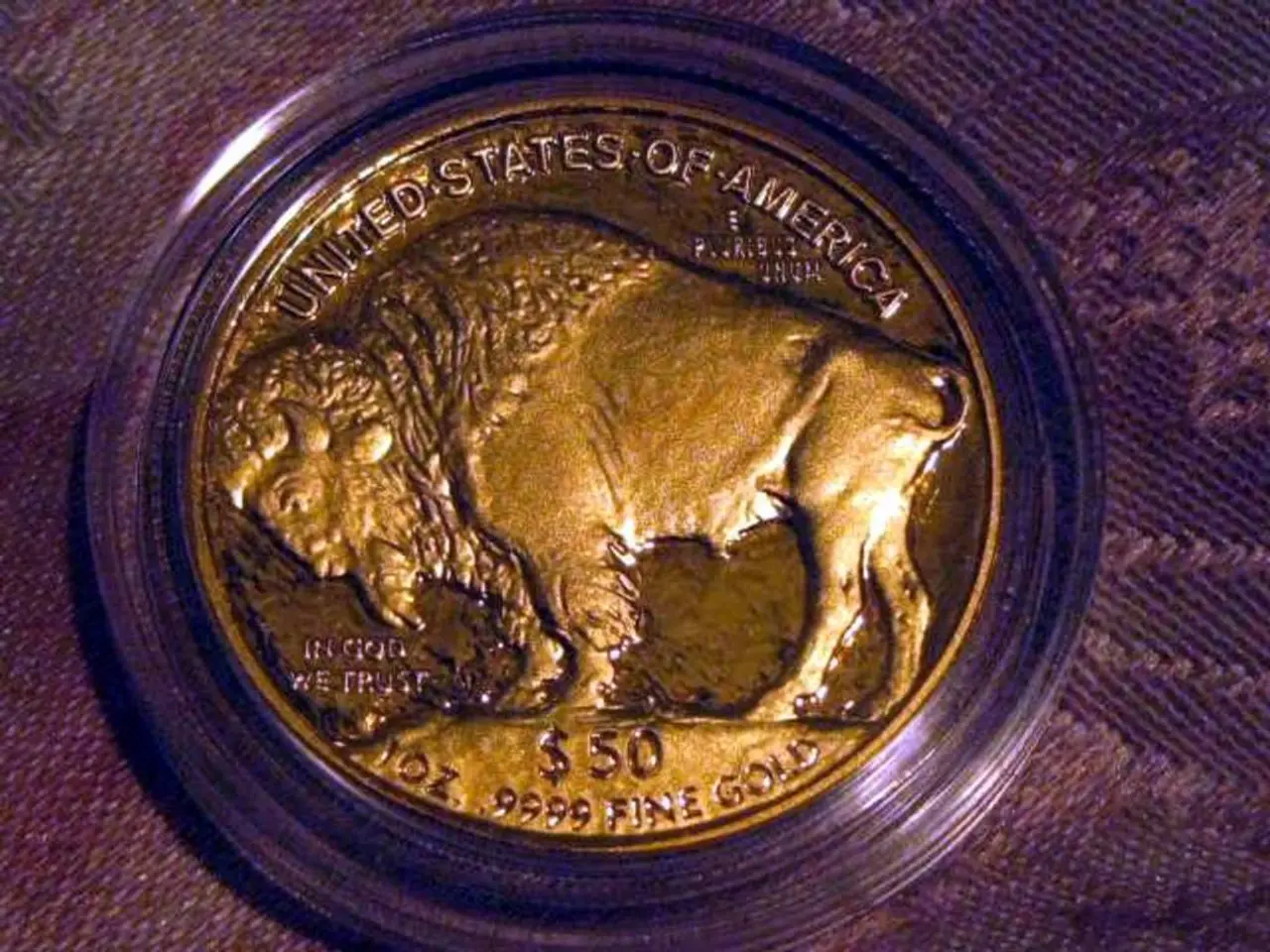

The dollar index, which measures the strength of the US currency against a basket of six major currencies, has risen by over 18 percent since the beginning of the year. This dollar strength, despite other central banks tightening their monetary policy at a historically high pace, could potentially lead to further downside potential for the S&P 500.

Morgan Stanley strategist, Michael Wilson, has correctly predicted the decline in US stocks this year. Wilson believes the latest rally in the US dollar is creating an "unsustainable situation" for risk assets, including stocks. He sees a possible trough for the S&P 500 index later this year or early next year at 3,000 to 3,400 points, indicating further downside potential of 8 to 19 percent.

Large profit disappointments are not yet priced into consensus estimates, according to Wilson. The profits of the S&P 500 for the fourth quarter will face a headwind of about 10 percent from the stronger currency. The S&P 500 index has already lost around 23 percent since the beginning of the year.

Investors are pouring money into cash and shunning almost every other asset class, according to strategists at Bank of America. However, the strategists at Bank of America did not provide a specific downside potential for the S&P 500 in their statement. EPFR Global data shows investors are as pessimistic as they were during the global financial crisis.

The US Federal Reserve has raised interest rates five times this year, most recently on September 22 to a total of 3.00 to 3.25 percent. The European Central Bank (ECB) is currently pursuing a high-interest rate policy, but it has been more cautious and slower in its rate hikes compared to the Fed. The Fed’s rate cuts in 2024 lowered rates to 4.25–4.50%, with limited room for further cuts in 2025, while the ECB has signaled one or two rate cuts depending on economic conditions but still maintains relatively high rates to control inflation.

The market is increasingly concerned that the US central bank could overshoot its target, leading to a potential economic slowdown. In the past, such dollar strength has led to some kind of financial or economic crisis. As the S&P 500 index faces a test of the crucial 200-week line, investors are bracing for a challenging period ahead.

Read also:

- Peptide YY (PYY): Exploring its Role in Appetite Suppression, Intestinal Health, and Cognitive Links

- Toddler Health: Rotavirus Signs, Origins, and Potential Complications

- Digestive issues and heart discomfort: Root causes and associated health conditions

- House Infernos: Deadly Hazards Surpassing the Flames