Large-scale Bitcoin holder transfers 2,000 BTC to acquire approximately 219 million USD worth of ETH through a substantial swap operation

Bitcoin OG's Bullish Bet on Ethereum Sparks Market Interest

In a move that has caught the attention of crypto enthusiasts and market observers alike, the mysterious Bitcoin investor known as "Bitcoin OG" has made a significant shift in his portfolio. This individual, who is often associated with the pseudonymous creator of Bitcoin, Satoshi Nakamoto, launched Bitcoin in 2009, has now turned his focus to Ethereum.

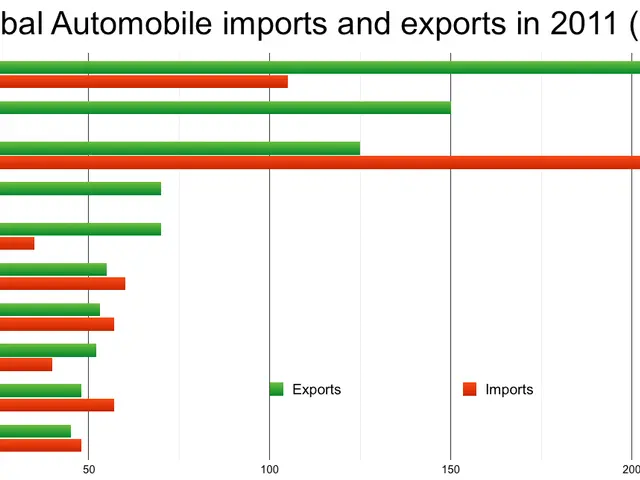

Over the course of a week, Bitcoin OG sold 3,968 BTC, worth approximately $221 million, and used the funds to purchase 96,531 ETH, valued at around $219 million. This move suggests a bullish outlook on the Ethereum market, and it's not the first time Bitcoin OG has shown interest in the second-largest cryptocurrency by market cap.

Market observers note that transactions of this scale can have a significant impact on price movements, particularly on the spot market for ETH. The repeated purchases of ETH by Bitcoin OG reflect a strategy of taking advantage of price fluctuations while building a long-term bullish position in Ethereum.

Traders often monitor large Ethereum wallets for clues about potential market direction. The Bitcoin OG's actions may influence market trends for both Bitcoin and Ethereum. After a brief pause, the investor deposited 1,000 BTC into Hyperliquid and used it to buy ETH on the spot market.

The Bitcoin OG's consistent accumulation of ETH indicates strong bullish sentiment towards Ethereum. Spot purchases of a significant amount of ETH can be seen as a confident vote in an asset's future performance. This investor's total Ethereum reserves now amount to approximately 691,358 ETH, valued at approximately $3 billion.

Ethereum has been fluctuating between $4,000 and $5,000, presenting opportunities for swing trading. The Bitcoin OG's strategy of alternating exposure between BTC and ETH to maximise profits and consistently increase ETH reserves is a strategy that many traders are watching closely.

Analysts suggest that activities by large crypto holders, like the Bitcoin OG, can generate both volatility and opportunities in the crypto markets. Investors are watching closely for the Bitcoin OG's next moves, as similar swaps could influence liquidity and sentiment in the Ethereum market.

This action signals growing confidence in Ethereum among large holders. The Bitcoin OG remains one of the largest private holders of Ethereum in the market. The pattern of calculated accumulation and targeted profit-taking by the Bitcoin OG signals continued confidence in Ethereum's potential.

In conclusion, the moves by the Bitcoin OG have sparked interest in the crypto market, with many analysts suggesting that this could be a sign of a bullish trend for Ethereum. As the market continues to evolve, the impact of large holders like the Bitcoin OG will undoubtedly play a significant role in shaping the future of the crypto market.

Read also:

- Peptide YY (PYY): Exploring its Role in Appetite Suppression, Intestinal Health, and Cognitive Links

- Toddler Health: Rotavirus Signs, Origins, and Potential Complications

- Digestive issues and heart discomfort: Root causes and associated health conditions

- House Infernos: Deadly Hazards Surpassing the Flames