Italian-Japanese automotive parts manufacturer Marelli plunges into Chapter 11 insolvency proceedings in the United States

Marelli Files for Chapter 11 Bankruptcy, Seeks to Strengthen Balance Sheet

Italian-Japanese automotive parts supplier Marelli has filed for Chapter 11 bankruptcy protection in the United States, aiming to strengthen its balance sheet and address industry-wide market pressures that have created a working capital gap.

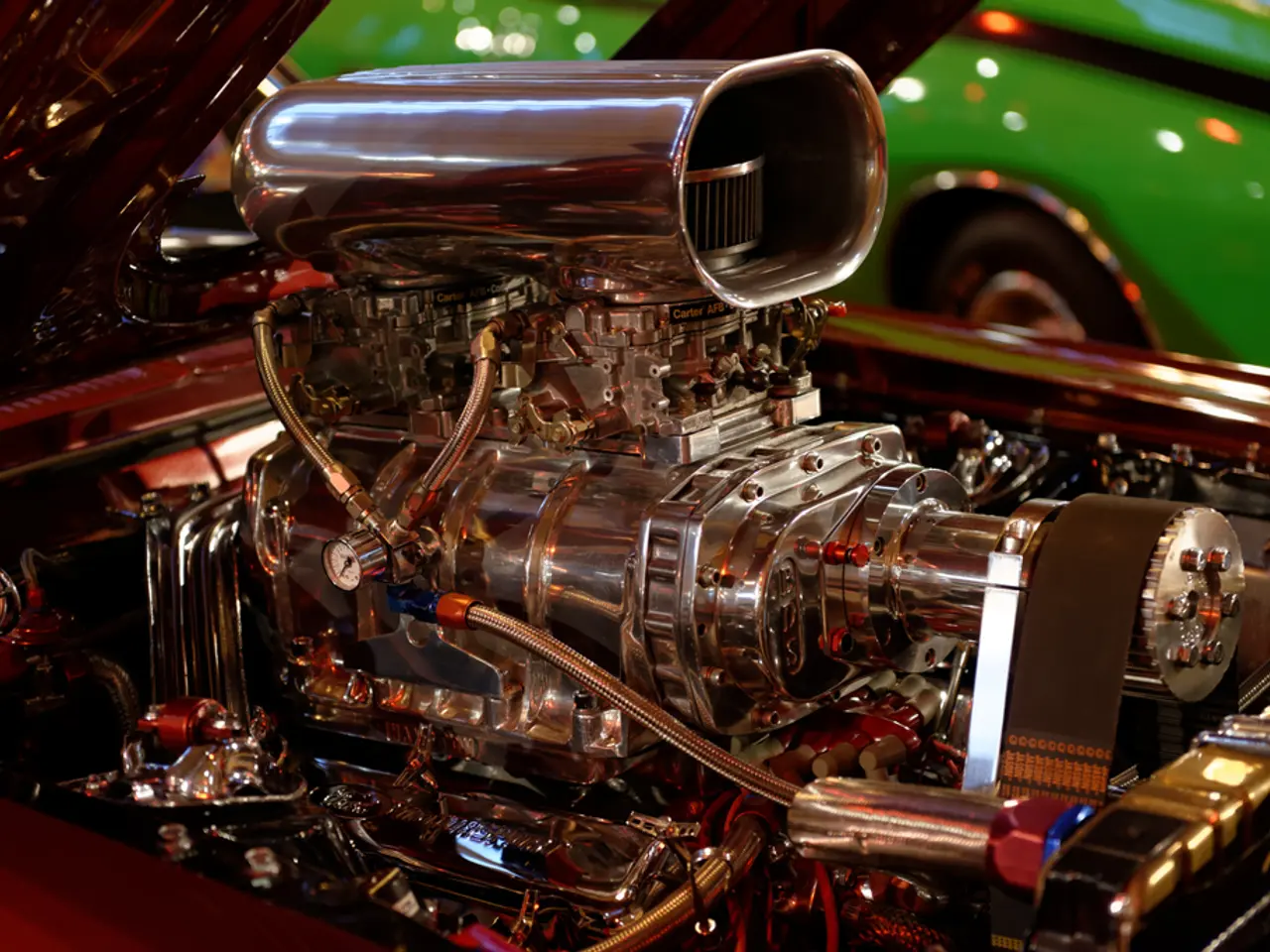

The filing, made on June 12, comes as Marelli grapples with a debt of $9.5 billion. The company, which is a key supplier to automakers such as Nissan and Stellantis, providing components for lighting, interior, propulsion, exhaust, and chassis parts, had previously been purchased by US private equity firm KKR in 2016 for 500 billion yen ($4.5 billion).

Marelli's President and CEO, David Slump, stated that the filing is intended to convert debt to equity, with the company expecting no disruption to its supply to OEMs such as Nissan and Stellantis. Marelli has submitted motions that would allow it to continue operations throughout the Chapter 11 process, including the continuation of programs that are integral to customer relationships.

The search results do not provide information about a company making an offer to buy Marelli or the amount announced by Marelli creditors around the end of May. However, it is reported that 80% of Marelli's lenders have signed a Restructuring Support Agreement, and Indian supplier Motherson Group is a potential bidder for the company.

Marelli's plants were shut down due to the Covid-19 pandemic, and the company had the highest fixed cost among its competitors, according to Chairman Dinesh Paliwal. The company received additional financing of $1.1 billion in debtor-in-processing (DIP) financing.

The 45-day overbid process allows other companies to purchase Marelli, with court approval required for the company to continue operations. Support remains from Marelli's partners, including Nissan, which has discussed a new strategic playbook for supply chain management to mitigate shocks and remain agile.

Tier-n visibility through digital tools is vital in managing supplier relationships, according to Gerardo de la Torre of Nissan. The full interview with Gerardo de la Torre can be read here.