Casinos Owned by PAGCOR Potentially Subject to Sale under BBM Administration

New Kid on the Block: Bongbong "BBM" Marcos, the Philippine's New President

Stepping into the limelight this year, Bongbong "BBM" Marcos, a descendant of the influential Ferdinand Marcos Sr. – a former president, and Imelda Romualdez Marcos – a former first lady, has taken the reins of the Philippines. His family's controversial past is marred by excessive spending, which some argue was a significant factor in the country's economic downturn and the bankruptcy of the national bank.

However, much like his predecessor, Rodrigo Duterte, BBM exhibits a populist and autocratic bent.

A New Dawn for PAGCOR, an Old Debate

Now, under BBM's watchful eye, the Philippine Amusement and Gaming Corporation (PAGCOR) finds itself under the magnifying glass. The organization, which functions as both gambling regulator and operator, might need to reevaluate its roles to avoid conflicts of interest.

Philippine Finance Secretary Benjamin E. Diokno called for PAGCOR to clarify its responsibilities – in reality, the finance secretary's request translates to the president's desire for PAGCOR's gambling operations to be privatized.

The new chair of PAGCOR's board of directors, Alejandro H. Tengco, shares a close relationship with BBM. This could signal dramatic changes ahead for the gambling regulator, despite BBM stopping short of dismissing Andrea Domingo, the incumbent chief executive.

E. Diokno, in his recent address, emphasized the need for PAGCOR to lay out a roadmap to recovery, ensuring that the economy "grows... recovers." He hinted at potential "additional resources" accessible through the privatization of certain companies.

While privatization usually correlates with increased profits for businesses, in PAGCOR's case, it might backfire. Already funneling all of its revenue into the state, PAGCOR supports a multitude of programs for mainly underprivileged residents or those impacted by natural disasters.

Déjà Vu All Over Again

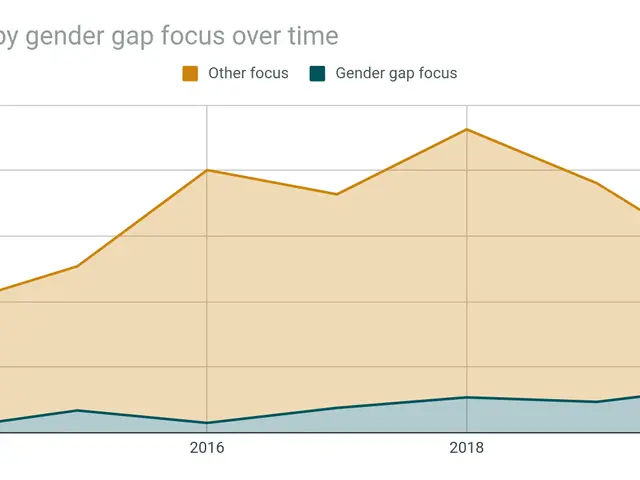

PAGCOR has faced similar pressure in the past under Duterte, who sought to sell casinos to secure immediate cash for the state. The idea to sell 17 properties was proposed in 2016, with Duterte ordering the sale of all 47 properties initially.

However, enthusiasm for quick cash subsided as PAGCOR properties continued to generate substantial cash flows. During the pandemic, these properties proved to be important lifelines. Nevertheless, under BBM, the idea of selling these lucrative state-owned businesses could be resurrected. Perhaps it's not the best choice this time around.

In a broader context, privatization efforts like these could also reflect underlying political alliances and power dynamics in the Philippines. Any significant economic policy move could impact associations and political stability, especially given the current strains in the Marcos-Duterte alliance[5].

So, as PAGCOR prepares to navigate uncertain waters, it's essential to consider the potential implications of privatization on the economy, the organization's efficiency, and society as a whole.

- Bongbong "BBM" Marcos, the new president of the Philippines, is faced with a legacy corresponding to his forebear, Ferdinand Marcos Sr.

- The controversial past of the Marcos family, which includes excessive spending, is believed to have contributed significantly to the country's economic downturn and the bankruptcy of the national bank.

- Much like his predecessor, Rodrigo Duterte, BBM exhibits a populist and autocratic bent.

- The Philippine Amusement and Gaming Corporation (PAGCOR), under BBM's watchful eye, might need to reconsider its roles to avoid conflicts of interest.

- Finance Secretary Benjamin E. Diokno has called for PAGCOR to clarify its responsibilities, which in essence translates to the president's desire for PAGCOR's gambling operations to be privatized.

- The new chair of PAGCOR's board of directors, Alejandro H. Tengco, shares a close relationship with BBM, signaling possible changes for the gambling regulator.

- E. Diokno has emphasized the need for PAGCOR to lay out a roadmap to recovery, ensuring the economy grows and recovers.

- He hinted at potential additional resources accessible through the privatization of certain companies.

- While privatization usually leads to increased profits for businesses, it might backfire for PAGCOR, as it currently funnels all of its revenue into the state.

- PAGCOR supports various programs for mainly underprivileged residents or those impacted by natural disasters.

- PAGCOR faced similar pressure for privatization under Duterte, who sought to sell casinos to secure immediate cash for the state.

- The idea to sell 17 properties was proposed in 2016, with Duterte ordering the sale of all 47 properties initially.

- Enthusiasm for quick cash subsided as PAGCOR properties continued to generate substantial cash flows.

- During the pandemic, these properties proved to be important lifelines.

- Under BBM, the idea of selling PAGCOR's lucrative state-owned businesses could be resurrected.

- Privatization efforts could also reflect underlying political alliances and power dynamics in the Philippines.

- Any significant economic policy move could impact associations and political stability, especially given the current strains in the Marcos-Duterte alliance.

- As PAGCOR prepares to navigate uncertain waters, it's crucial to consider the potential implications of privatization on the economy, the organization's efficiency, and society as a whole.

- The gambling industry, including entities like PAGCOR, can play a significant role in the nation's wealth management and investing opportunities.

- The industry also provides career prospects, from business and careers in housing markets to venture capital, personal finance, banking, and insurance.

- Entrepreneurship, particularly in the form of small businesses, can flourish in the gambling sector, offering diverse roles in leadership, diversity and inclusion, and education and self-development.

- The economy's growth and stability can depend on the industry's productivity and responsible gambling practices.

- The gambling sector can contribute to the country's financial growth, as well as the development of real estate, residential, commercial, and stock markets.

- Private equity, saving, and debt management are crucial aspects of the industry, requiring careful budgeting and careful planning.

- Mindfulness, personal growth, and lifelong learning can help individuals make informed decisions in managing their finances and careers within the gambling sector.

- Casino culture, general news, crime and justice, learning, goal setting, career development, casino-and-gambling, casino-games, lotteries, Las Vegas, gambling trends, casino personalities, policy and legislation, and politics are all interconnected aspects of the gambling and finance industries.

- Online education, job-search, poker, learning, and skills-training can provide opportunities for individuals who wish to pursue a career in finance or the gambling sector.

- Responsible gambling practices, such as setting limits and seeking help, are vital components of promoting a sustainable and healthy gambling environment for both individuals and society.